The alternative protein industry demonstrated remarkable resilience and growth in 2025, with over 661 employers posting at least one job opening during the year. This surge in hiring signals strong momentum for the future of sustainable food, even as the sector navigates complex regulatory landscapes and market challenges.

California Dreams: US Dominates with 1,500+ Future Food Jobs

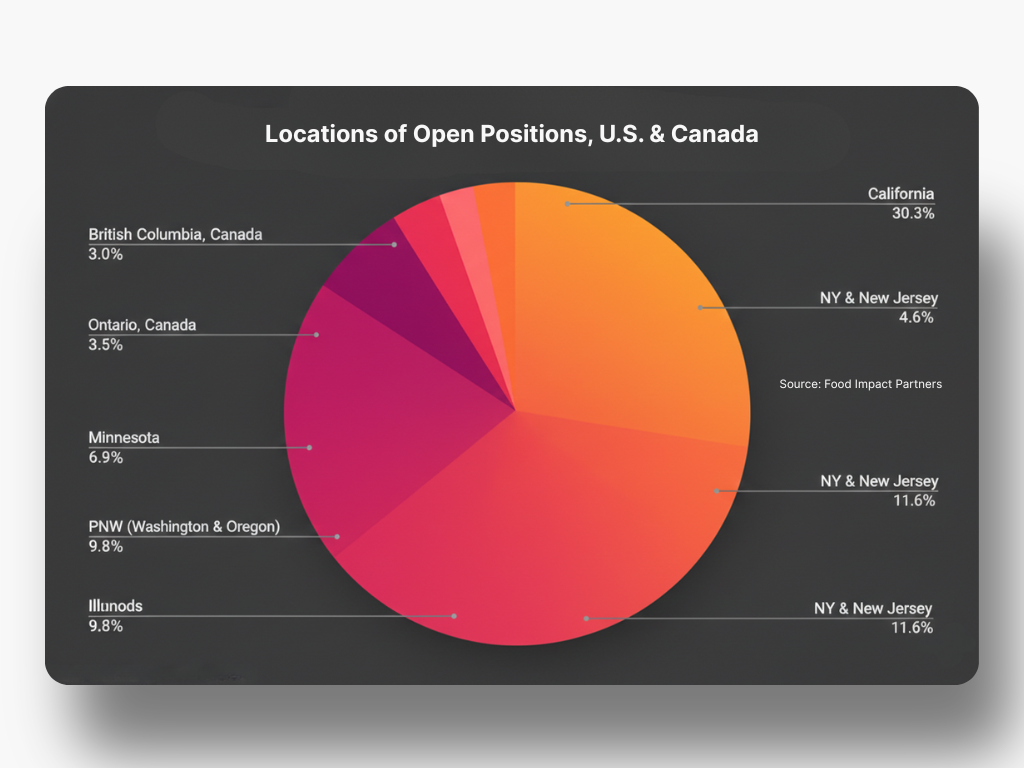

According to new analysis from recruiting group Food Impact Partners, future food companies in the United States posted more than 1,500 open roles in 2025—the highest of any country. California emerged as the hotspot for alternative protein employment, driven by companies like The Every Company, Upside Foods, Pulmuone Foods, Califia Farms, Prime Roots, and Prolific Machines.

Lab-Grown Meat Goes Mainstream: Cultivated Protein Companies Race to Hire Before Commercial Launch

2025 proved to be a significant year for cultivated meat hiring, driven by regulatory approvals in the US, Singapore, and Australia. Despite some high-profile closures, several companies ramped up recruitment in anticipation of commercial launches.

Believer Meats posted 21 roles across departments through Q3 2025 before its unexpected shutdown in December. Upside Foods was second with 14 postings, while Mewery and Hoxton Farms each posted 10 roles. Notably, Hoxton Farms received the most engagement through the Food Impact Careers platform across the entire alternative protein sector.

“Several companies are on the cusp of commercialization, necessitating a new area of talent to be added to their teams,” says Golan. “I’ve always said that cultivated meat is an inevitable reality; the question is when and where the breakthroughs will happen.”

Europe’s Secret Weapon: Why This Region Is Winning the Alt-Protein Talent War

While the US led in absolute numbers, Europe demonstrated outsized impact relative to its population, accounting for approximately 37% of global job posts with just over 1,100 positions. Germany topped European charts with more than 230 postings, followed closely by the UK with over 215 roles.

Particularly noteworthy is Denmark, which recorded more jobs per million citizens than any other country. “Relative to its population, Europe accounts for a disproportionately large share of job posts compared to the rest of the world,” explains Noga Golan, founder and CEO of Food Impact Partners.

European hiring trends revealed a distinct focus on operational excellence, with job posts heavily skewed toward operations, supply chain, food safety and quality assurance, bioprocess, manufacturing, and regulatory-adjacent functions. “From a global perspective, Europe is where alt protein turns from science into industry,” Golan notes.

Oatly’s Comeback Story: Plant Milk Giant Posts 40+ Jobs After Profitability Milestone

Pea protein processor Puris dominated the hiring landscape with over 70 open roles, making it the company with the most job openings in 2025. Oatly followed with more than 40 positions across Europe and North America—a positive sign for the oat milk pioneer after several challenging years that included layoffs and factory closures.

Oatly’s 2025 hiring spree aligned with its first quarter of profitable growth since its 2021 IPO. The company’s job postings focused on operational and commercial roles including sales, operations and supply chain, manufacturing, food safety and QA, and regional marketing—indicating a mature strategy centered on driving revenue and improving cost discipline.

The Hottest Jobs in Alt-Protein: 730 Marketing Roles Signal Industry’s Commercial Shift

Marketing and sales emerged as the most popular hiring category, with 730 roles advertised, reflecting the industry’s shift toward commercialization. Food safety and quality assurance followed closely with 650 roles—a segment that typically spikes when companies expand manufacturing capacity or prepare for retail and foodservice scale.

“As alternative protein companies prioritized commercialization and scale-up, 2025 saw a strong focus on sales and marketing hires,” reports Anna Heslop, global director of recruitment at Food Impact Partners. “Clients consistently noted the challenge of finding commercial leaders able to bring novel ingredients to market with established players, despite limited resources.”

Demand for food safety and quality assurance roles more than doubled in 2025 compared to 2024, while bioprocess-related positions increased by over 50%.

What’s Next: GLP-1 Drug Boom Creates New Career Opportunities for Food Scientists

Golan forecasts increased interest in senior-level nutritionists who can help companies navigate dietary shifts resulting from the rise in GLP-1 medication use. Additionally, improved access to capital signals positive momentum for the industry.

Companies showing notably higher job posting activity in 2025 compared to 2024 included Daiya, The Every Company, Puris, Upside Foods, and SuperMeat. Conversely, Flora Food Group (formerly Upfield), Impossible Foods, Nature’s Fynd, Pulmuone Foods, Perfect Day, Three Trees, and Tofurky posted fewer openings year-over-year.

The hiring trends paint a picture of an industry in transition—moving from pure research and development toward commercial scale, operational excellence, and market penetration. As regulatory frameworks continue to evolve and consumer acceptance grows, the alternative protein sector appears poised for continued expansion in 2026 and beyond.